Renters Insurance in and around Virginia Beach

Renters of Virginia Beach, State Farm can cover you

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

Calling All Virginia Beach Renters!

Home is home even if you are leasing it. And whether it's a condo or a house, protection for your personal belongings is beneficial, especially if you own items that would be difficult to fix or replace.

Renters of Virginia Beach, State Farm can cover you

Coverage for what's yours, in your rented home

Protect Your Home Sweet Rental Home

It's likely that your landlord's insurance only covers the structure of the apartment or home you're renting. So, if you want to protect your valuables - such as a bicycle, a guitar or a coffee maker - renters insurance is what you're looking for. State Farm agent Pierre Granger is passionate about helping you choose the right policy and protect yourself from the unexpected.

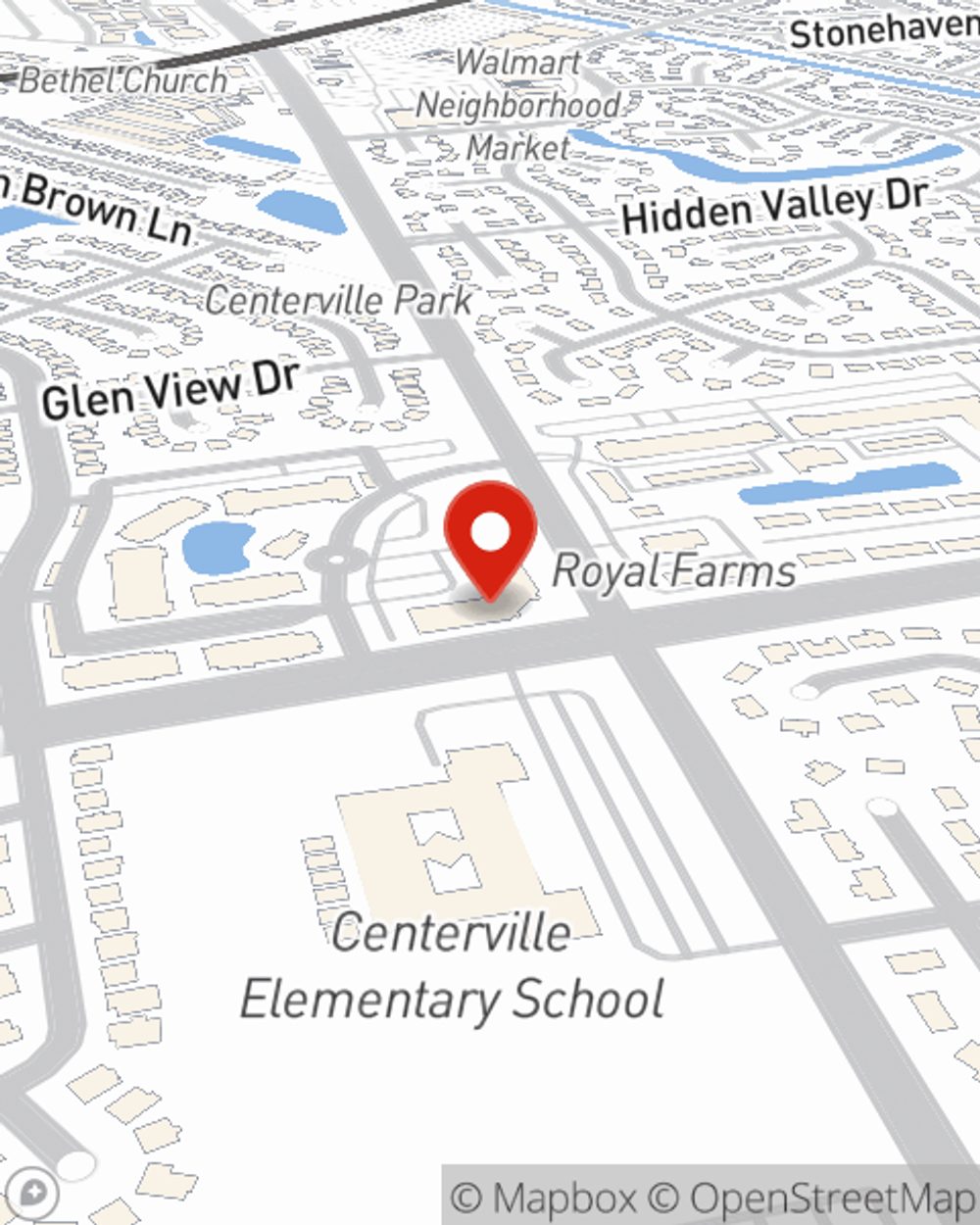

Visit Pierre Granger's office to explore how you can save with State Farm's renters insurance to help keep your valuables protected.

Have More Questions About Renters Insurance?

Call Pierre at (757) 962-2266 or visit our FAQ page.

Simple Insights®

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

What to do after a house fire

What to do after a house fire

Consider these tips to help you and your family recover after a house fire.

Pierre Granger

State Farm® Insurance AgentSimple Insights®

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

What to do after a house fire

What to do after a house fire

Consider these tips to help you and your family recover after a house fire.